FACTORING -An Alternate Way of Working Capital Finance

Prelude:

Factoring is a rapidly growing tool used as an alternative for working capital finance. Under this program FFIL will provide finance against client’s credit invoice(s) for supply of goods/services. This will help the client to get a significant portion of the invoice amount soon after the delivery of goods or services.

- 1.Objectives:The objectives of the Factoring are –

- Unlock the working capital requirement

- To achieve –

- Effective monitoring, and

- Timely recovery

- Revolving finance (short term)

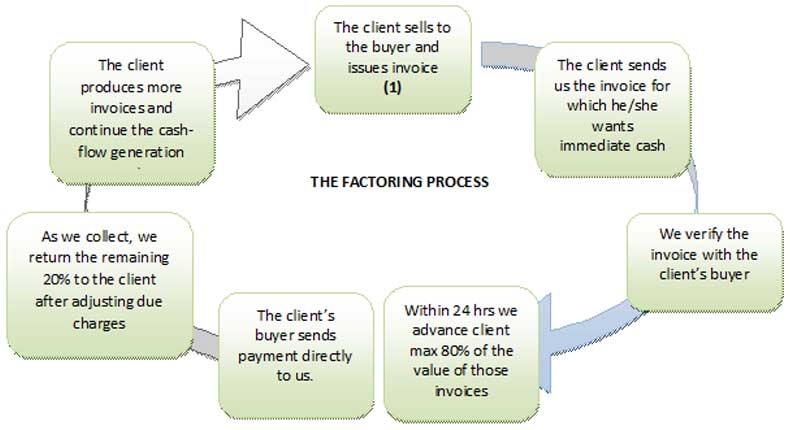

- 2.The Product Functioning Process:

- The buyer places order to the seller (the client).

- The client approaches FFIL for approval of the Factoring Facility against the order.

- After analyzing the buyer strength and client’s standing with the buyer, FFIL approves the facility.

- Mutual correspondence among the buyer-client-FFIL confirms the payment of bill by the buyer to FFIL.

- After being confirmed of the facility approval and payment assurance to FFIL’s account, the client will deliver the goods/services to the customer.

- The client will assign the bill/invoice to FFIL.

- FFIL will disburse payment (maximum 80% of the invoice value) to the client.

- After the bill/invoice maturity the buyer will make payment directly to FFIL.

- FFIL will reimburse the balance amount to the client after recovering the loan along with service charges.

Mode of Operation of Factoring Facility:

FFIL will formally inform work order issuer(s) (the buyer) about the facility provided to the ‘Client’ accompanied with a letter from the client with the request to assign all invoices to FFIL. The buyer will express their consent in written form. After executing the work order, the client will place the invoice to FFIL marked “ASSIGNED AND PAYABLE TO FFIL”. FFIL will provide maximum 80% of the invoice amount as short term finance to the client and will receive the payments directly from the buyer on due date. FFIL, after deducting the principal amount along with the accrued interest and service charge, will reimburse the balance amount to the client.

The Process Flow Chart:

- 3.Allowable Debt:Debt which is eligible to be purchased by FFIL; means –

- in relation to which the client is not in breach of any warranty;

- debt which was not previously notified by the client to FFIL;

- debt where the client have clear ownership over the product or services

- debt where the buyers’ capacity to pay-off the debt is clearly justified

- debt where the buyer and seller has mutually agreed to assign FFIL as the only collector of debt.

- Maximum Credit Term: 45-180 days from the invoice/bill date.

- Currency: Bangladesh Taka

- CIB report of the client must be unclassified.

- 4.Security:

- Factoring Agreement with Recourse

- Personal Guarantee of the sponsor(s)

- Deed of Floating Charge on all book debts (account receivable present and future)

- A cheque covering the full facility amount

- 5.Period of Agreement:1 year (renewable) from the date of agreement

- 6.Recourse:FFIL will have a right of recourse to Client to the fullest extent in respect of any Debt purchased by FFIL if that Debt or any part thereof is unpaid by its due date or if there is breach of Agreement.